Does Chase Business Have Zelle

PNC and Zelle do not offer a protection program for any authorized payments made with Zelle. While the name has changed none of the other features benefits have.

Chase Quickpay With Zelle Guide Limits Enrolling 2021 Uponarriving

Chase does not charge a fee to send or receive money with Zelle Send money to almost anyone with a bank account in the US.

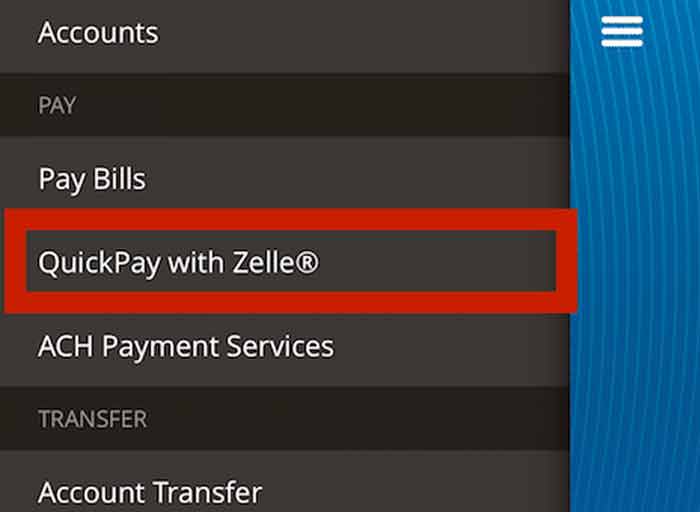

Does chase business have zelle. Select transactions could take up to 3 business days. Until recently Zelle was called Chase QuickPay with Zelle. Simply login and choose QuickPay with Zelle in the side menu to.

Zelle is already in over a thousand banking apps. Check here to see if they offer Zelle. Thats why were working with banks and credit unions to make it fast free 1 and easy to send money to almost everyone you know even if they bank somewhere different than you do.

To find out if Zelle is in yours search the list below for the bank or credit union. Similarly Zelle doesnt have a robust fraud protection program. Zelle payment service Zelle is a United States-based digital payments network owned by Early Warning Services a private financial services company owned by the banks Bank of America BBT Capital One JPMorgan Chase PNC Bank US Bank Citibank and Wells Fargo.

Footnote 1 details 1 Transactions typically occur in minutes when the recipients email address or US. Note that some banks only offer Zelle for personal account transfers and not for B2B transactions. Zelle is used by many other major banks and its a standalone app as well.

Mobile number is already enrolled with Zelle. Neither Zelle nor the participating financial institutions offer a protection program for any purchase or sale conducted using Zelle in other words if you initiate the transfer and mistakenly send it to the wrong person or to a fraudster Zelle. How do I know if another small business or consumer can pay me with Zelle.

However Zelle does have a few limitations. Do not use Zelle to send money to people you do not know and trust. Chase QuickPay with Zelle is the same thing as Chase QuickPay.

If you have not yet enrolled your Zelle profile follow these simple steps. Footnote 2 details 2 Must have a bank account in the US. If you do not know and trust the person we recommend that you use another form of payment.

Zelle and the Zelle related marks are wholly owned by Early Warning Services LLC and are used herein under license. Zelle is a fast and easy way to send money to family friends and others you trust 1. Zelle is our person-to-person payment feature.

Zelle is simply the company that runs the program Chase uses for this service. Send and receive money in moments so no more waiting days or paying fees like other apps. At this time only those enrolled with Zelle through their banking app are able to send and receive money with eligible business accounts.

If your bank or credit union does NOT offer Zelle - The person you want to send money to or receive money from must have access to Zelle through their bank or credit. Business owners with small business checking or savings accounts can likely use Zelle right away since most major banks have integrated Zelle into their mobile banking applications. From Chase business checking accounts you can send up to 5000 in a single transaction up to 5000 a day and 40000 in a calendar month.

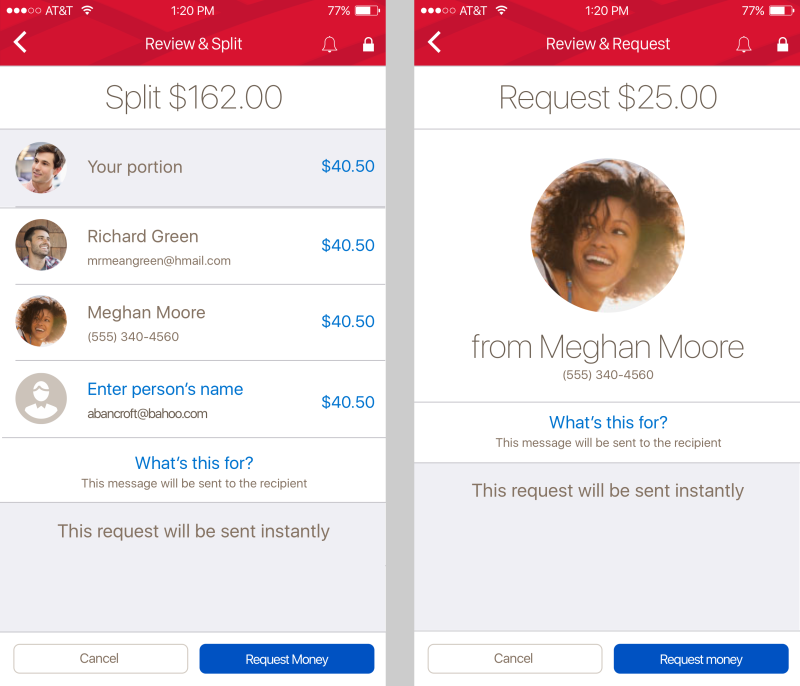

For your protection you. Zelle payments are usually processed instantly making this an easy way to split the cost of a taxi with friends or contribute to buying a shared gift for example. Enrollment in Zelle is required.

Quickly receive or send payments with Zelle Use Zelle to get paid or send payments to eligible suppliers and vendorsin moments. Both parties need a US. Sending money to friends and family should never slow you down.

The easiest way to find out is to simply ask if theyre enrolled with ZelleIf its a consumer let them know they can look for Zelle in their banking app. If your bank or credit union offers Zelle - You can send money to almost anyone you know and trust with a bank account in the US. You can send or receive money between most bank accounts in the US.

If you have already enrolled with Zelle you do not need to take any further actionThe money will move directly into your bank account associated with your profile typically within minutes 1. Zelle is an easy way to send money to friends family or other people that you know and trust. 2 typically within minutes 3 using just an email address or US.

Funds are typically made available in minutes when the recipients email address or US. Only one needs an eligible Chase account. Chase QuickPay with Zelle is now just Zelle.

Zelle and the Zelle related marks are wholly owned by Early Warning Services LLC and are used herein under license. You shouldnt use it to pay someone you dont know and you cant send or. Each financial institution that offers Zelle sets its own limits on the amounts their customers may send to others.

It is a fast easy and convenient way to send and receive money from customers at other member banks such as Bank of America Wells Fargo and US.

Chase Quickpay With Zelle Guide Limits Enrolling 2021 Uponarriving

Mobile Online Banking Videos Helpful Tips Chase Com

Chase Quickpay With Zelle Guide Limits Enrolling 2021 Uponarriving

How To Enroll In Zelle Chase Mobile App Youtube

Send Money To Friends Or Other Bank Accounts Instantly With Zelle Formerly Chase Quickpay Clearxchange Send Money Chase Account Chase Bank Account

Expired Chase Use Chase Quickpay With Zelle Get 5 10 Doctor Of Credit

Zelle For Business Guide Fees Which Banks Use Zelle More

Chase Quickpay Everything You Need To Know About Free Money Transfers

Chase Pay Vs Chase Quickpay Complete Guide 2021

How To Use Chase Quick Pay With Zelle For Free Basic Transfers

Mobile Online Banking Videos Helpful Tips Chase Com

Mobile Online Banking Videos Helpful Tips Chase Com

Chase Quickpay With Zelle Guide Limits Enrolling 2021 Uponarriving

Chase Pay Vs Chase Quickpay Complete Guide 2021

J P Morgan Chase Bank Of America Roll Out Answer To Zelle Money

Posting Komentar untuk "Does Chase Business Have Zelle"